bexar county tax office pay online

The Bexar County Tax Office offers the option of paying your Property Taxes online with either a major credit card or an electronic check ACH. Please contact the JP of your choice for detailed information andor to schedule a marriage ceremony.

A Reminder To All Bexar Bexar County Texas Government Facebook

Can I Pay My Property Taxes Online In Bexar County.

. You will immediately receive an emailed receipt. Thank you for visiting the Bexar County ePayment Network. The Texas Legislature does not set the amount of your local taxes.

The bexar county tax office offers the option of paying your property taxes online with either a major credit card or an electronic check ach. Credit card payments are processed through jetpay which charges a 210 convenience fee. Bexar county tax office pay online Monday February 21 2022 Edit 2021 Best Places To Live In Bexar County Tx Niche Bexar County To Transform Operations With Telework E Government System Bexar County Property Owners Have Until May 17 To Appeal 2021 Property Appraisals Officials Say Understanding Your Bexar County Property Taxes Youtube.

The second part of the property tax equation is the property tax assessment which determines the value of your property. Central Standard Time on January 31 are considered timely. The hays county tax office also collects property taxes for all other taxing jurisdictions school districts cities and special districts.

Please select the type of payment you are interested in making from the options below. After locating the account you can pay online by credit card or eCheck. 18500 - 35499 65 of jobs The average salary is 51377 a year.

Box 830248 San Antonio TX 78283. Bexar County Property Tax Loans Ovation Lending To pay real property Tagged bexar county office Discover. The result is that Bexar County uses a property tax rate of 197 which is huge.

27000 is the 25th percentile. Click here to register online on TxDMV website. Some counties allow renewals at substations or subcontractors such as participating grocery stores.

Prior year data is informational only and does not necessarily replicate the values certified to the tax office. Salaries below this are outliers. Property tax payment methods online.

For questions regarding tax amounts visit the County Tax Office Website email or call 210 335-2251. In addition to Bexar County and the Flood Control Fund the Office of Albert Uresti Bexar County Tax Assessor-Collector has a contractual agreement to collect and disburse property taxes for 56 separate taxing jurisdictions. Tax Rate In Houston HOUSTON CN Two Texas Republicans prevented their Democratic.

Payments made online by 1159 pm. Please follow the instructions below. Clicking on the link below will take you to to a webpage with specific information and instructions for making that type of payment through our convenient and secure online.

Many counties allow you to renew your vehicle registration and change your address online. Marriages Bexar County TX Official Website. Please allow up to 15 days for the processing of your new window sticker or new plates by mail.

In 2018 the Bexar County Tax Office issued license platesstickers for over 16 million vehicles processed 491927 title transfers issued 30349. 411 North Frio Street San Antonio TX 78207 Mailing Address. Box 839950 San Antonio TX 78283-3950.

Welcome to the Bexar County ePayment Network. Your property tax burden is decided by. This includes 24 municipalities 12 school districts and 21 special districts.

Other locations may be available. All properties are taxed by Bexar County Flood Control Alamo Community. Bexar County Tax Assessor-Collector Office P.

Find your next job near you 1-Click Apply. 210-335-2221 Marriage Marriage ceremonies are done by all Justices of the Peace by appointment only. Browse 4342 BEXAR COUNTY TAX OFFICE Jobs 27K-100K hiring now from companies with openings.

After locating the account you can also register to receive certified statements by e-mail. Property Tax Overpayments Search for any account whose property taxes are collected by the Bexar County Tax Office. Tax Bills Who to Contact for Tax Bills.

1 days ago How Much Do bexar county tax office jobs Pay per Year. Acceptable forms of payment vary by county. The Bexar County Tax Office offers the option of paying your Property Taxes online with either.

Paying your County Property Taxes online by either mailing a check or using one of the online options offered by the Bexar County Tax OfficeYour bank account will be billed as long as your payment is not cleared. Online Services Information Lookup. This website provides information concerning proposed property taxes that may be imposed on properties by local taxing units the dates and locations of public hearings concerning budgets and tax rate adoption as well as other important information.

10 in favor of a proposal to raise the countys property tax rate by 8. Please select the type of payment you are interested in making from the options below. The Bexar County Tax Office collects ad valorem property taxes for Bexar County the Road and Flood Control Fund and 57 other taxing entities.

A property with an appraised value of 152400the median value in Bexar will be landed with an annual property tax bill of 3000. The tax increase would have raised the bill for an owner of. You can pay your property tax online using an eCheck a credit or debit card or PayPal.

Unless exempt by law all real and business personal property are taxable. For information on obtaining a Marriage License please contact the Bexar County Clerks Office at 210-335-2221 or visit the. Please contact your county tax office or visit their Web site to find the office closest to you.

Property Tax Payments Online. You can search for any account whose property taxes are collected by the Bexar County Tax Office. Bexar county tax office pay online.

Property Tax Information Bexar County Tx Official Website

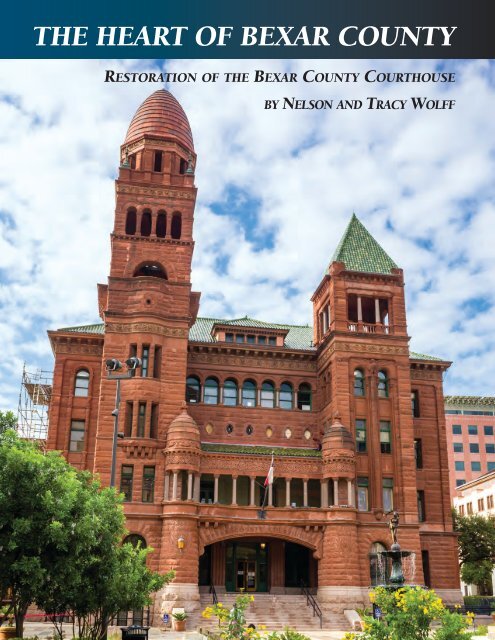

Inventory Of County Records Bexar County Courthouse San Antonio Texas Volume 1 The Portal To Texas History

Real Property Land Records Bexar County Tx Official Website

Bexar County S First Virtual Civil Jury Trial Delayed San Antonio News San Antonio San Antonio Current

Bexar County Delinquent Property Taxes Find Out About Bexar County Property Tax Rates More Tax Ease

Bexar County Tax Office To Stay Open But Close Lobbies What That Means For You

Bexar County Jail Detained A Man For Five Extra Months There S No Clear Answer To Why Texas Standard

Bexar County Precinct 1 Justice Of The Peace Court In San Antonio

Payments Bexar County Tx Official Website

Bexar County Tax Office West Side 8 Tips From 506 Visitors

Everything You Need To Know About Bexar County Property Tax

Bexar County Property Tax Loans Ovation Lending

Bexar County Tax Collector Albert Uresti On How The Coronavirus Is Affecting Property Taxes In San Antonio